Index Strategies

Research Affiliates®

Global Multi-Asset Index (RAGMAE)

AT A GLANCE

Uses Research Affiliates’ proprietary research and aims to provide broad diversification and stable returns through volatile markets.

The Research Affiliates Global Multi-Asset Index (RAGMAE) provides diversified exposure to global equities, bonds and commodities through futures contracts, while utilizing a proprietary risk management process to manage volatility. Leveraging Research Affiliates’ decades long experience forecasting returns across asset classes and deep expertise in multi-asset investing, this index utilizes systematic, rules-based signals to create a strategy that seeks to outperform based on where markets are expected to go, not where they’ve been.

Thoughtfully designed to deliver for investors

RAGMAE

- Strategic allocation determined by our capital markets forecasts

Strategic allocation uses proprietary long-term future expected return models to identify underpriced assets. - Tactical overlay that responds to short-term market movements

Uses carry, value and momentum signals to respond to short-term market forces that impact income, valuation and momentum. - Proprietary volatility management process

Proprietary risk controls target a 5% volatility and focus on improving the risk/return tradeoff by reducing positions when market risk is significantly elevated.

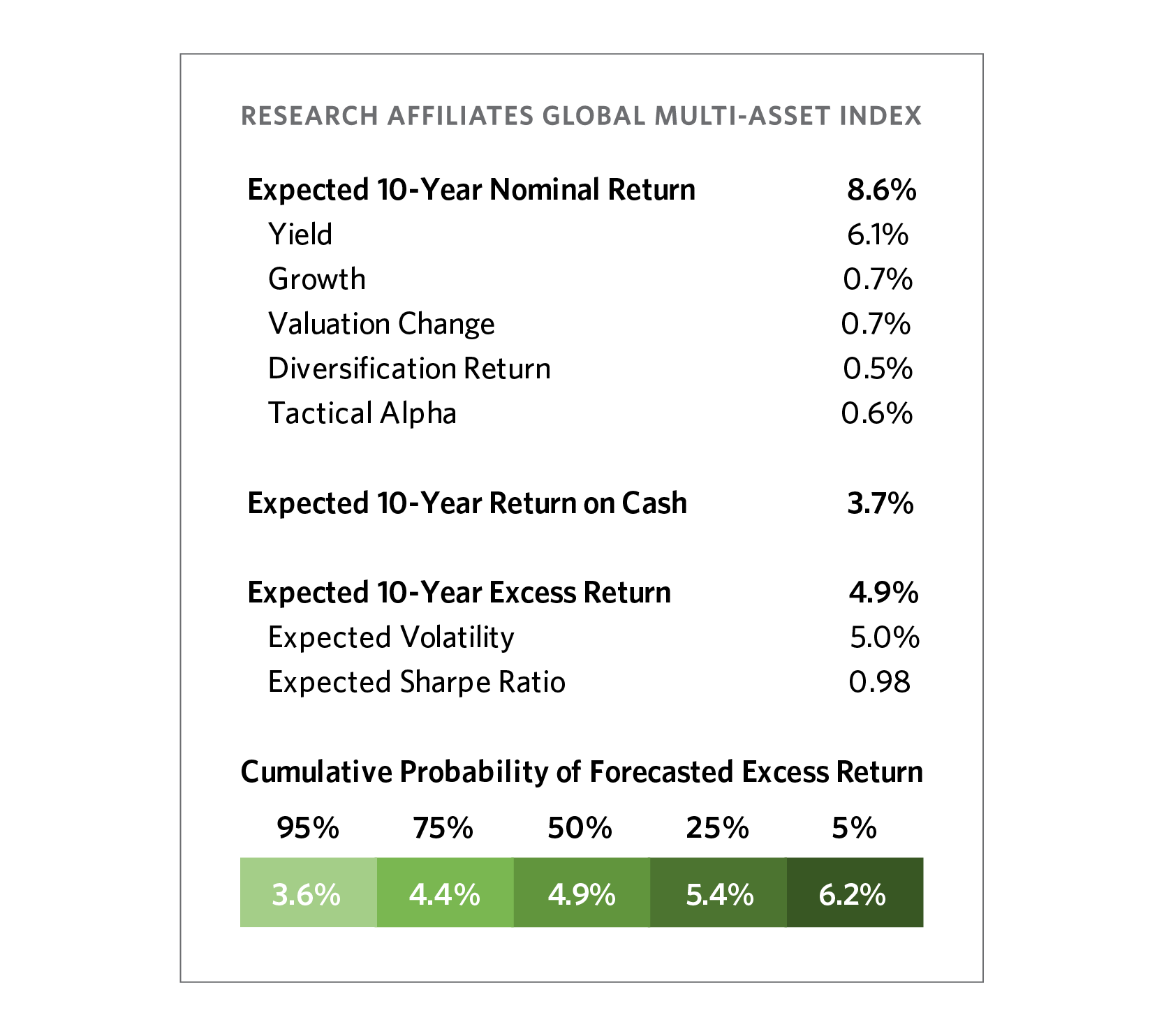

Expected 10-Year Excess Return Forecast

Our forecasting models are grounded upon a solid economic foundation. They reflect current market conditions rather than relying simply upon past returns. We use a "building block" approach to forecasting where we estimate key predictors of return for each asset within the index.

- Yield: Steady state return expected from holding index assets (e.g. current yield for bonds and dividend yield for stocks).

- Growth: Return from the expected growth, reflecting increased prices from growing cash flows (e.g. GDP growth).

- Valuation Change: Return assessing the fair value of each asset (whether the asset is cheap or expensive and assuming mean reversion).

- Diversification Return: Return from holding and rebalancing a diversified set of assets.

- Tactical Alpha: Additional return expected from making short-term tactical allocation adjustments.

These building blocks form the core of our 10-year index forecast. To learn more about our forecast methodology, please visit: Research Affiliates Capital Market Expectations Methodology.

Source: Research Affiliates, LLC, as of December 31, 2025, based in USD.

Note: All data presented herein are forward-looking estimates based on simulated portfolios computed by Research Affiliates, LLC, and do not reflect the performance of any product or strategy. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time, and speak only as of the date they are made. Research Affiliates, LLC assumes no duty to and does not undertake to update forward-looking statements. The data are based upon reasonable beliefs of Research Affiliates, LLC, but are not a guarantee of future performance. Actual results may differ materially.

RESEARCH AFFILIATES GLOBAL MULTI-ASSET INDEX

Inception date: 11/24/2023

Performance Snapshot

Can't find what you're looking for? Let us know.