Research

Factor Investing

Factors represent investment characteristics that help explain a security's behavior. Smart beta techniques can deliver efficient exposures to desired factors.

Factors help explain the behavior of a security

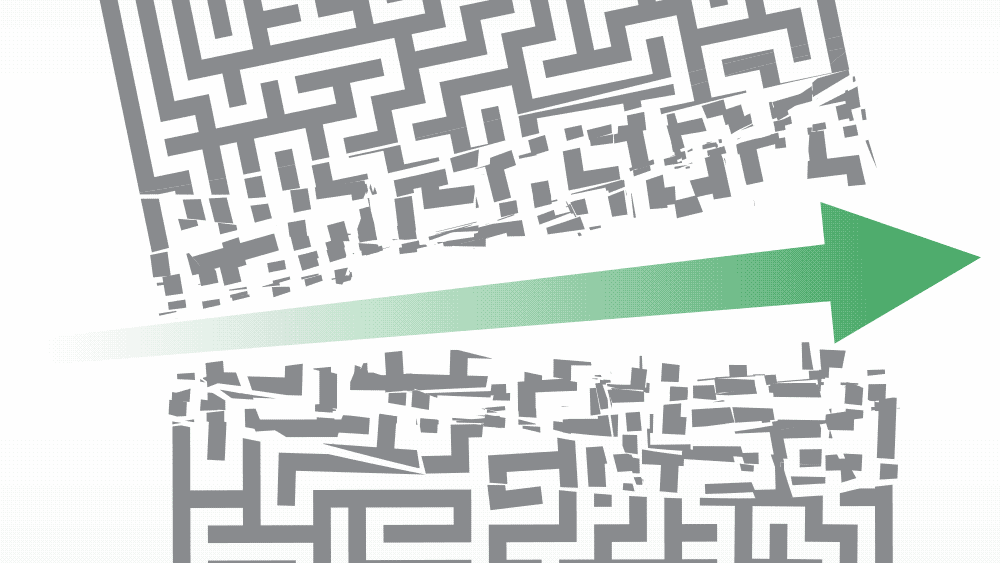

Investors frequently view smart beta through the lens of risk-and-return drivers, connonly known as factors. The two terms are often used interchangeably despite core differences. Factors represent investment characteristics that help explain security's behavior, Smart Beta, breaks the link between price and weight in a portfolio. A smart beta strategy can be combined with factor return premiums to deliver efficient exposures, net of transaction costs, to investors.

Factor proliferation increases the importance of

identifying robust factors

The growth in popularity of factor investing has created some confusion. The market has been flooded with an egregious number of presumed “factors” backed by positive backtests, although many may be the sole result of data mining. We believe it is more important now than ever to understand the risk preferences and/or behavioral anomalies driving factor premiums and to be skeptical of newly discovered factors.